What Are the Tariffs Exploiting in Fashion?

Will luxury survive? Will our consumption slow? Nothing is certain, and the setback will be long term

Ah, the current event we have all been WTF-ing over since Inauguration Day. Of course.

We’ve witnessed a frenzy of negotiations, press conferences, threats, and flashbacks to Trump’s unilateral protectionist trade strategy from his first term. Brands have posted to social media and their email base to notify if and how their prices or wholesale are affected. Shoppers are encouraging each other to buy the things on their wishlist now, before they become unavailable or unaffordable. Trump stands ten toes down while the rest of the world navigates whether they need to continue operating alongside the US, or if they can create their own system without us in it.

At minimum, the sweeping announcements followed by 90 day delays in quick succession has left businesses and the stock market paralyzed. There is a human element lacking in these actions (surprise, surprise), and by decentering the backbone of the global value chain the Trump administration’s tariffs break down the fabric holding it together. But isn’t “shaking it up” his intention???, you may counter. Yes — but without a so-called “just” transition plan for material sourcing, laborers and pricing, among other elements, a hard and fast tariff plan is set up for failure.

In regards to the fashion industry, there’s a lot at stake. Let’s take a look at the immediate impacts, responses thus far, and what it means for our plans as shoppers.

THE IMPACTS

On April 9th, President Trump announced a 90-day pause on his reciprocal tariffs for all countries except China. Time will tell if the existing tariffs will move ahead or be a tool for bullying.

According to Re/Make’s projections, garment workers will suffer the most from tariffs. Countries like Myanmar, Laos and Cambodia were slapped with rates over 40%, and China is a whopping 145% as it stands now. These are epicenters for fashion and textiles: Myanmar alone earned over 3.1 billion dollars from finished garment exports in 2024. These nation-states are experiencing extreme levels of vulnerability to both trade and the climate — Myanmar is also recovering from a 7.7 magnitude earthquake that killed 3,000 people.

Garment production is a lifeline for millions of workers. We want to pay fair and liveable wages, and reward countries that hold higher labor protection standards, but pulling the rug out from under an exporter we have significant investment in creates critical, long lasting harm in both political and economic terms for both countries.

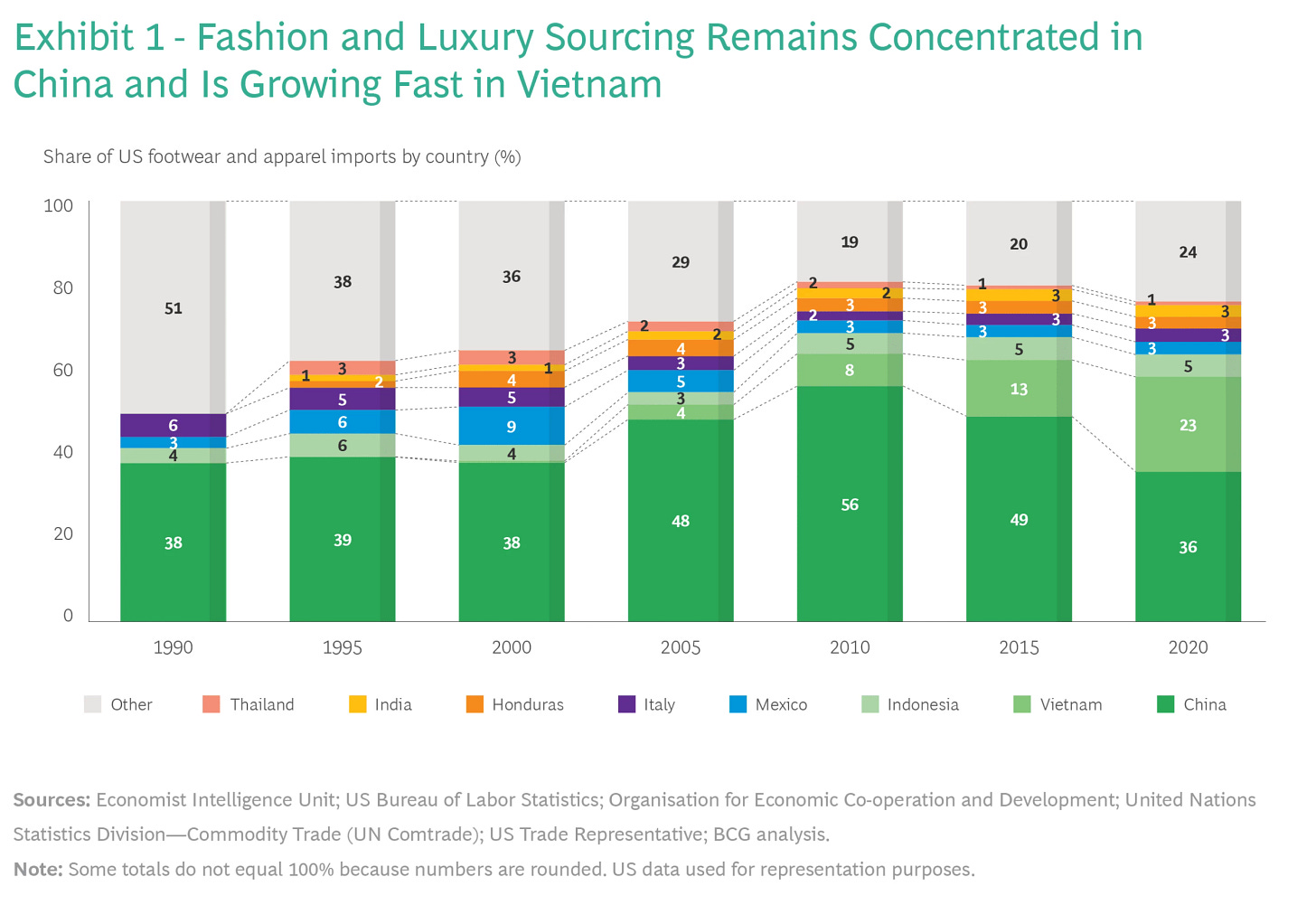

THERE IS NO LOCAL VALUE CHAIN UNDER CAPITALISM. The actions by the Trump admin expose the intricate dependencies in the global network of fashion supply chains. Vietnam is a major exporter for US tech and clothing companies like Nike and Apple. Bangladesh, where garment manufacturing makes up to 80% of its total exports, will be subjected to 37% levy, while the EU, which accounts for at least 70% of the global luxury goods market, will be hit by a 20% tariff. Stefano Martinetto told BoF the tariffs could set the industry back 50 years, saying “European designers could end up selling mostly in Europe,” and so it may also follow for the US.

There are fears that for some consumers, cheap dupes — already prevalent & known to fuel human trafficking and labor exploitation — will become more favorable (Business of Fashion). Increased consumer costs won’t likely curb the appeal for fashion’s core luxury audience, but aspirational shoppers are expected to be priced out. The fluctuation in attention from attracting younger, aspirational audiences (see: logomania and streetwear collabs) and retaining profits from deeper pocketbooks is a growing brand risk when society is increasingly engaging with economic disparity and the possibility of a recession. Luxury giants may be able to overcome this seismic shift, but how are smaller independent designers going to survive?

THE RESPONSES

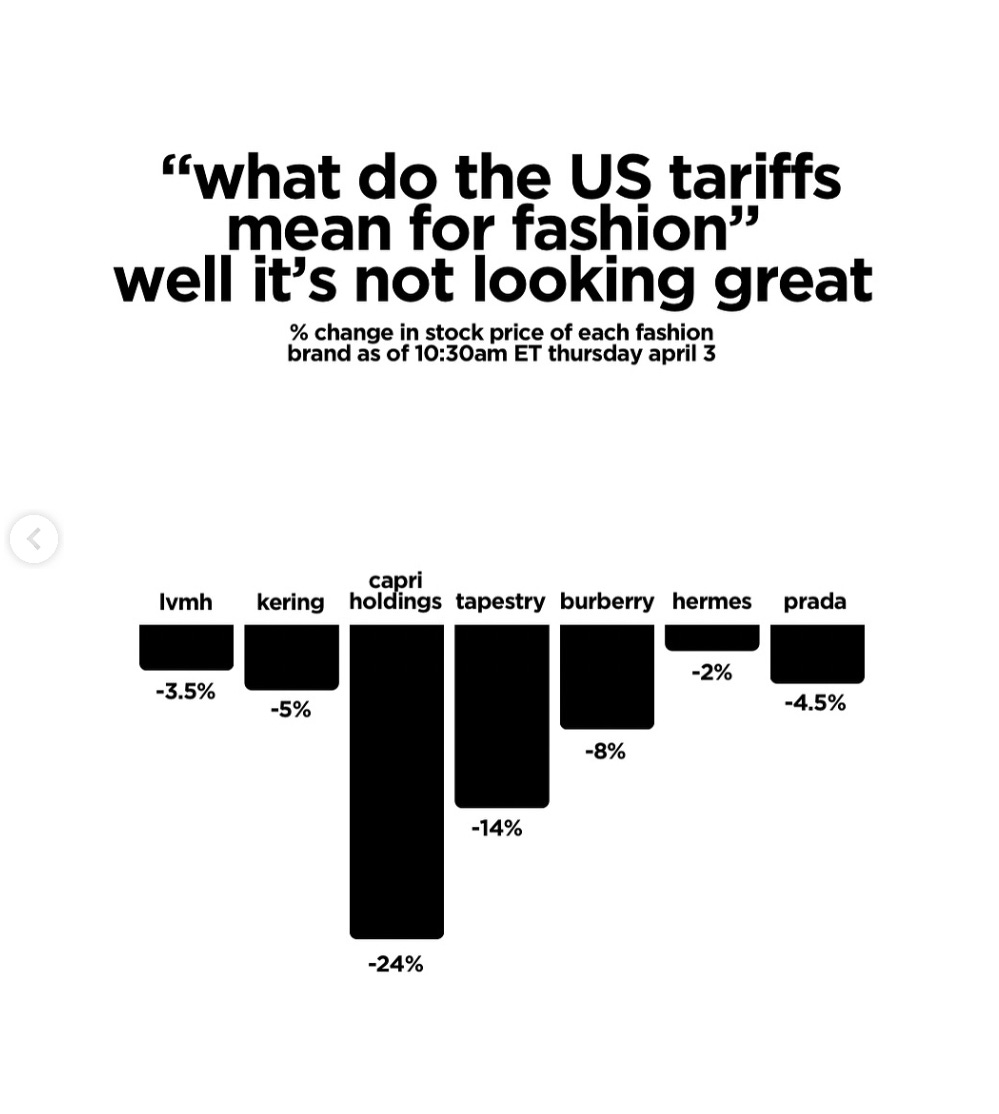

The stock market has declined more under Trump than under any other president to this point in their presidency since the Dow was created. It has been volatile for shares in the fashion industry. According to Business of Fashion, Lululemon shares dropped over 10 percent, while shares of Nike and Ralph Lauren fell 7 percent.

Obviously China hit back, with their own tariff hike from 84% to 125%. We have always been in a trade war with China, but we also have no just transition in this Made in America scheme for American businesses, who likely source from China as its sole affordable option. We can’t return to an era that no longer exists, let alone lacks incentivization to restart at home.

Meanwhile, 70 other countries have reached out to negotiate "tailor-made deals."

There have been mixed messages from Trump advisers — some insisting that the tariffs are permanent, others saying they're a negotiation tactic.

"There can be permanent tariffs — and there can also be negotiations because there are things that we need beyond tariffs," Trump told reporters.

Whatever the fuck that means. It was clear in his first term that he believes America can bully nations into complying with its agenda far easier when he can break down the validity of international global organizations (IMF, WTO, ICC, NATO) and attack in unilateral negotiations. Canada and Mexico, for example, are far easier to attack 1v1 than when they play as a team; I’ve noticed the nation-states that are finding the most trouble staying afloat are the ones who don’t band together with their neighbors to push back against him.

Despite Brexit’s initial move challenging the state of the European Union, the EU has survived and carried on without them. Now the UK government is trying to find its way back in one way or another — I always say, men come back or their lives get worse! However, it didn’t come to this point without years of crises and chaos that have defined modern Britain. Now, economists expect similar results in the global trading system via Trump’s tariffs.

Eswar S. Prasad, a professor of trade policy at Cornell University stated, “Logically, this would be a time when the rest of the world bands together to promote free trade among themselves…The reality is, it’s going to be every country for itself.”

Can a sans-American trading bloc develop and grow to be successful as a result, or are we destined for “every man for themselves”? Are we driving nation states to China, despite most of Trump’s aggression targeted at debilitating them?

At minimum, this has removed the US from being the center of major global free trade. It sounds a lot like how my parents used to deal with my tardiness growing up: I thought I could steal away a few more minutes and lose track of time, meanwhile everyone was in the car pulling out of the driveway. I would hear the garage door open and start hustling out the door to jump in before they left without me — what is our government going to do when we inevitably fall behind?

WHERE IS THE JUST TRANSITION?

“You can’t just pull out the tariff hammer to swing at every problem without a clear, defined end goal. We cannot underestimate or under-appreciate the time and capital it’s going to take to actually bring jobs and supply chains back home. So, there’s not a shortcut here.”

Governor Gretchen Whitmer

The bailout will have to be huge. It’s questionable whether we can shoulder that much to recover. NPR found the first Trump administration spent $28 billion bailing out farmers. This time around, the tariffs are much higher, and it's unclear how long they will persist. Previous relief plans lacked a long term sustenance, and now the tariffs pose a steeper hill to climb. How far behind will American exporters and businesses fall as a result? Will other countries shift their preference to American competitors that have cheaper exports?

Michigan Governor Gretchen Whitmer delivered an address where she warned about the dangers of sweeping tariffs, arguing that consumers will pay the price (literally). Manufacturing states like Michigan are particularly threatened, due to a reliance on border-crossing supply chains. Again, Made In America isn’t what it seems.

In climate circles, the term just transition will often pop up when discussing environmental action, especially when it becomes a complete overhaul of the existing system. Climate action must take into account the jobs that will be gained and lost (or redistributed), upskilling and education needed, land repurposed or restored, observing any connection to indigenous cultures, and what learned behaviors have to come undone for their work to be accepted and incorporated into society. The White House believes they can eschew any of this responsibility in their mission to “make other countries pay their debts” …

Over 97 percent of apparel and shoes in America are manufactured overseas. Government support for US-based design and production is nonexistent: tariffs are enacted in their name, yet the provisions required to successfully transition major garment production and business operations are, similarly, nowhere to be found. Businesses are neither enticed to channel their focus stateside nor bolstered enough through subsidies or funding to avoid drowning.

WHAT IT MEANS FOR AMERICAN FASHION

The companies importing these products have to eat government imposed price hikes, left to determine how much of that tariff to pass on to the consumer to make up the difference. Many will likely choose to charge a higher retail price, coming out of the customer’s wallet, or by opting for cheaper-quality goods (The Cut). In either scenario, we are losing out on quality and accessibility.

With Americans already weary from inflation, experiencing a debt crisis and spending more carefully, consumer confidence is at an all time low. Not to mention, it’s common practice for manufacturers to cut corners to keep prices down. What will absorbing the costs look like when a majority of garment workers are already paid below a liveable wage?

There’s no silver lining to defeat fast fashion, either. Shein and Temu will become more expensive due to increased shipping costs, but fast fashion will always find the loophole: moving manufacturing and warehouses to countries that are cheaper or less regulated, evading higher taxes, etc. Regulations, be it economic or ethics-based, will always have those who cheat the system.

Trump claims the tariffs “will pry open foreign markets and break down foreign trade barriers, and ultimately more production at home will mean stronger competition and lower prices for consumers.”

Lower price where??? That won’t be the case for major players in fashion, like Nike. Footwear and apparel manufacturing won’t just return to the United States at the turn of a hat. Labor in Vietnam costs $3.10 per hour, for example, far below the average US manufacturing wage of $28.64. If brands couldn’t initially afford manufacturing stateside, outpricing foreign labor doesn’t solve the feasibility issue… it just sets up a brand to suffer and lose.

ARE THERE ANY WINS FOR SUSTAINABILITY… ?

It’s easy to overconsume in preparation for disaster — ie, a significant reduction in American pocket change — but it shouldn’t be our aim. It’s reminiscent of toilet paper shortages in early Covid days, except many of these clothes aren’t needs but wants. Americans already shop and create waste more than we should, so perhaps this is our sign to shift attention away from the market and towards each other. Will brands also look to recirculate their existing goods to find profit in new pathways, in turn finding themselves at the feet of environmentalism? I am equally doubtful and optimistic.

The price hikes may drive more people to secondhand. A 2025 report found that approximately one-third of all clothing and apparel purchased in the U.S. over the past year was secondhand (NPR). Covid saw a similar boom in resale and secondhand.

Could it also provide a more competitive landscape for your local upcycler? Or will their sourcing grow costly, despite being single-handedly produced entirely in the US.

Some say there is good news for the planet baked into this sh*tstorm. Higher prices can incite slow consumption. We can get the thing we want, but it will be missing a core piece of sustainable fashion: accessibility. If it ain’t affordable, the consumer slowdown isn’t effective as a eco-fashion strategy. Instead, it exposes a vulnerability in the system.

Even before Trump’s second term, sustainability efforts in the industry have felt defeating. Fur is suddenly back in droves again, decarbonization promises from large brands like Adidas, Prada, Gap and Inditex have hardly made traction, and the concept of sustainability itself has wavering interest from consumers. With these conditions, it can be incredibly difficult to garner economic investment in circular fashion, despite it being a secondary source of revenue that can become quite profitable. Yet, most brands prove their intentions center around short term profit. And so the tariffs and the White House’s antics continue to propagate a haywire situation.

—

In sum, the effects will be a defining moment in the business of fashion. With drastic market swings, brutal price hikes, and zero foresight into a supportive transitory period for American fashion, much is at stake of being on the chopping block. However, survival may be possible for 1) nation-states who choose to collaborate and maintain free trade channels, & 2) businesses who can lobby government to pressure the Trump admin to change direction.

ABOUT THE AUTHOR

Ryann Stutz is a part time writer, full time optimist looking to interrogate the existing world order (macro) and discover how she is meant to move through it (micro). Based in New York by way of London and, originally, Michigan.

The premise for this newsletter: tensions between an interest in pop culture/frivolity/humor & the politics of our bodies, our choices as a consumer, and of our environmental health.

EIGHT SECONDS!!

"lobby government" = grovel at the foot of the wannabe-king ((madface))